We are now faced with the fact that tomorrow is today. We are confronted with the fierce urgency of now. In this unfolding conundrum of life and history, there ‘is’ such a thing as being too late. This is no time for apathy or complacency. This is a time for vigorous and positive action.

Rev. Dr. Martin Luther King, March on Washington Speech, 1963

King’s movement was a human and economic justice movement for all people. The Covid Era is bringing the fractures of our tattered economic system into sharp relief, possibly reversing hard-won post-Civil Rights opportunities for all Americans. Racial inequity, sexism, wealth inequality, and climate change are four of the most pressing challenges of our times, undermining economic vitality, human health, natural environments, and the viability of our markets.

Small and medium sized businesses (SMEs) have not fared well in the pandemic economy. According to some estimates, 100,000 businesses have closed due to Covid so far. Although statistics are still emerging, nationally 800 businesses a day may be permanently closing. The situation has been even worse for women and people of color. Almost half of all Black businesses have closed. And Latinx businesses are endangered as well.

At the same time, the crisis is a ripe opportunity to remake business and finance models to expand equity and sustainability. The US will need to finance an inclusive recovery that supports SMEs, as theyemploy about 47% of all Americans, especially family-owned businesses, since they constitute 90% of all US businesses.

New forms of business financing, such as crowdfunding and social finance, including what’s known as “impact investing,” have grown dramatically, reaching at least $17 to $41 trillion globally and $291 billion in the US alone in the past two years. However, unfortunately, most US SMEs do not even know these financing forms exist, let alone how to access these resources, especially those that are community-based, family-led, women-owned, or people of color-founded. This largely untapped funding is a critical opportunity to rebuild businesses that will not only revive local economies but also address our most pressing social and environmental issues.

Fierce Urgency of Now is a 4-part blog series designed to explain social finance, also known as environmental, social, and governance (ESG) investing, in user-friendly terms so that family businesses are in a better position to access these resources. The series is structured around four topics and key questions.

Part 1 (below): The Emergent Business Finance Revolution: An Introduction to US SME Securities and Social Finance

What are the new financing options available to US SMEs and why should I spend my time learning about it?

Part 2: 21st Century Family Business Financing: From Crowdfunding, Social Finance, and Beyond (coming June, 2021)

How are these new financing forms structured, and which organizations are the key players in the US and California in particular?

Part 3: Making The New Finance Work: Pros and Cons for US Family Businesses (coming September, 2021)

What are the advantages and disadvantages of these new financing forms?

Part 4: Making the New Business Financing Real: Next Step Recommendations (coming December, 2021)

What can your business do to access these new resources, and how can the community help?

New SMEs Securities

Until a few years ago, it was difficult for SMEs to publicly raise funds from individual investors. But with the 2012 Jumpstart Our Business Startups (JOBS) Act, created by President Barack Obama, loosened Security and Exchange Commission regulations for businesses with less than $1 billion in revenue, allowing them to offer stock to potential individual, retail investors with fewer reporting and disclosure requirements. Before the JOBS Act, only wealthy people could invest in business start-ups. All types of businesses, regardless of focus, as well as for-profit, and even some cases non-profit, companies, can issue stock, pay dividends or other financial returns to investors. In some circumstances, investors own equity in business start-ups. SMEs can raise up to $50 million a year through a special JOBS Act provision, called Regulation A+.

Crowdfunding

We are all familiar with crowd funding sites such as Kickstarter and Indiegogo. However, such sites are not investment vehicles but donation vehicles. Donors do not earn dividends, other investment income, or gain equity in the company supported. Instead, they get perks, such as discounts or first access to purchase exciting new products.

However, with the JOBS Act, businesses can now raise up to $1 million a year from smaller, individual investors, that is, crowdfunding. These are typically time-limited investor fundraising campaigns conducted and managed online by various intermediaries specializing in these “raises,” as they are commonly called.

There are some estimates that the JOBS Act has created $300 million in new financing for US SMEs. As more businesses understand their options, the amount raised will increase. And there is pending legislation to allow SMEs to raise up to $5 million a year instead of just $1 million. In the next blog post, I will cover other emergent finance options for SMEs, including for-profit and, in some cases, nonprofit organizations too, as well as how businesses can access the funding.

Social Finance for Impact Businesses

Another new source of potential funding for many businesses is social finance, a broad term used to describe different forms of financing for organizations (businesses and nonprofit organizations) that promote a public good such as healthy environments, people, and organizations. Social finance has been around in some guise for centuries, including government bonds to fund public works, foundation grants, and other forms of funding for the public good.

But today it has become a sophisticated, and sometimes complex, investment sector, potentially offering both financial return as well as public benefit. Over the past decade, the sector has expanded immensely as the world’s social and environmental crises increase. Investors are demanding opportunities to fund businesses motivated by public good, not just profit. An example would new technology companies with alternative energy options such as solar or wind power to reduce carbon emissions and address climate change.

Also, the growing evidence shows that it is possible to earn a financial return on certain kinds of social and environmental initiatives is expanding the field. The goal is to attract private capital for the public good, providing investors a reasonable, balanced financial return and societal impact. This type of investing is called Environmental, Social, and Governance (ESG) investment and can fund businesses, for-profits or nonprofits with a public social, environmental, or health benefit. There is no standard definition of the type of business activity that constitutes ESG, and the various categories may overlap. Here is a typical classification.

Figure 1. ESG Investing Types

| Environmental | Social | Governance | |

| How society, including businesses uses, disposes of, renews, or regenerates natural resources necessary for life and business production | How society, including businesses, treat people and their communities | How ethically society and businesses operate to support broader society | |

| Definitions | Factors related to the natural world. These include the use of, and interaction with, renewable and non-renewable resources (e.g., water, minerals, ecosystems and biodiversity). | Management of human resources, local communities and clients. These are the factors that affect the lives of humans. | These are the factors that involve issues inherent to the business model or common practice in an industry, as well as the interest of broader stakeholder groups. |

| Examples | Climate change Natural resource depletion Waste management Pollution Deforestation Renewable energy Clean water | Human rights Modern slavery Child labor Working conditions Employee relations, including staff and vendor diversity, equity, and inclusion | Bribery and corruption Executive pay Board diversity and structure Political lobbying and donations Tax strategy |

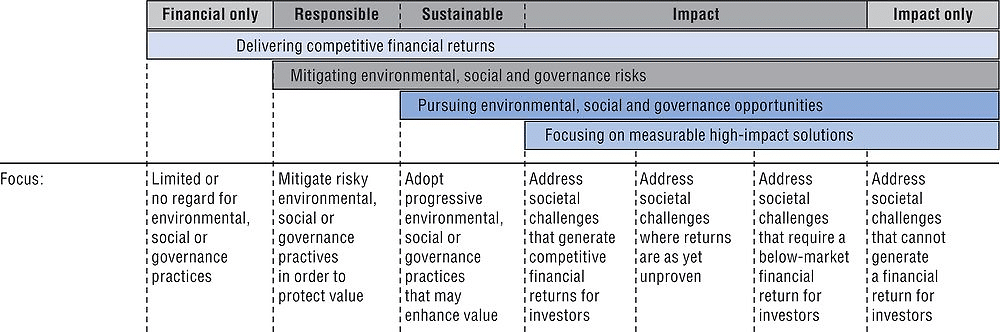

There is a spectrum of 9 different types of ESG Investing defined by the extent they expect a financial return versus primarily a public benefit.

Figure 2. The Social Finance Spectrum

If your business works in any of these areas, it is important that you know about social finance and how you can access these investors to sustain your operation. Having defined these new resources, the rest of Fierce Urgency of Now series will focus on how US family-led SMEs can access ESG Investors, particularly impact investing, to support their businesses as well new retail investors through crowdfunding and other options created by the JOBS Act. I will describe both the opportunities and challenges presented by these funding resources and end the series with practical steps your business can take to access these resources nationally and in California. These largely untapped resources are critical to help revive US SMEs and neighborhood economies post-Covid. I look forward helping family businesses access this emerging funding in these critical times.

About the Author

Jacqueline Copeland is a Gellert Family Business Fellow. Annually, Fellows are selected by the Gellert Center because of their expertise working with family-owned firms and their recognized positions as leaders in family enterprise theory and practice over many years.

An award-winning human rights advocate and scholar, Dr. Jacqueline Copeland is the founder of The Women Invested to Save Earth Fund (The WISE Fund) and Black Philanthropy Month. An impact entrepreneur, she specializes in social finance to promote funding equity for innovators addressing the world’s key social, environmental, and health challenges. Her Gellert Fellow op-eds represent her own opinions and not necessarily those of her affiliated organizations, including University of San Francisco Business School where she serves as Fellow for the Gellert Family Business Resource Center.